- The Wave Report – by CrypFlow

- Posts

- The Wave Report #4 - Why the BTC bull run isn’t done yet

The Wave Report #4 - Why the BTC bull run isn’t done yet

What past cycles teach us about the road ahead.

If you think the bull run is over… think again.

When Bitcoin breaks into price discovery, it doesn’t go straight up. It climbs, corrects, consolidates, then climbs again. This week, we’re zooming out to study how each cycle unfolded once new all-time highs were broken.

Spoiler: the current cycle still has room to run.

🔍 2013 Cycle: 3 major corrections after price discovery

Once BTC broke its 2013 ATH (~$1250), it entered price discovery and:

🚨 Correction 1 -40%

🚨 Correction 2 -40% again

🚨 Correction 3 -30% before topping out at ~$20,000

The structure: pump → dip → pump → dip → blow-off top.

Price discovery wasn’t a straight line. But the macro trend was undeniable.

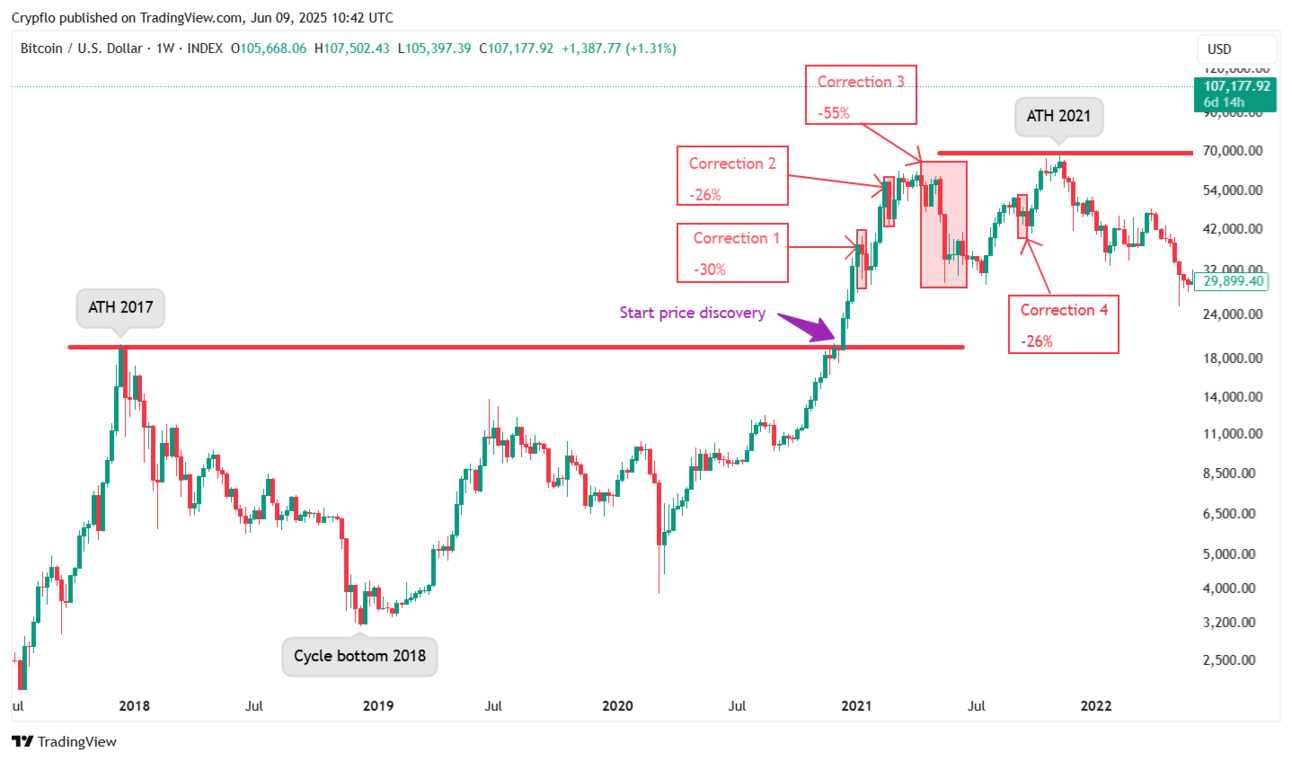

🔍 2017 Cycle: 4 corrections in blue-sky mode

Breaking above the 2017 top (~$20,000), BTC entered a strong trend, but still corrected multiple times:

🔻 Correction 1: -30%

🔻 Correction 2: -26%

🔻 Correction 3: -55% (mid-cycle flush)

🔻 Correction 4: -26% before the final ATH of $69,000 in 2021

Each shakeout removed weak hands and set up the next leg.

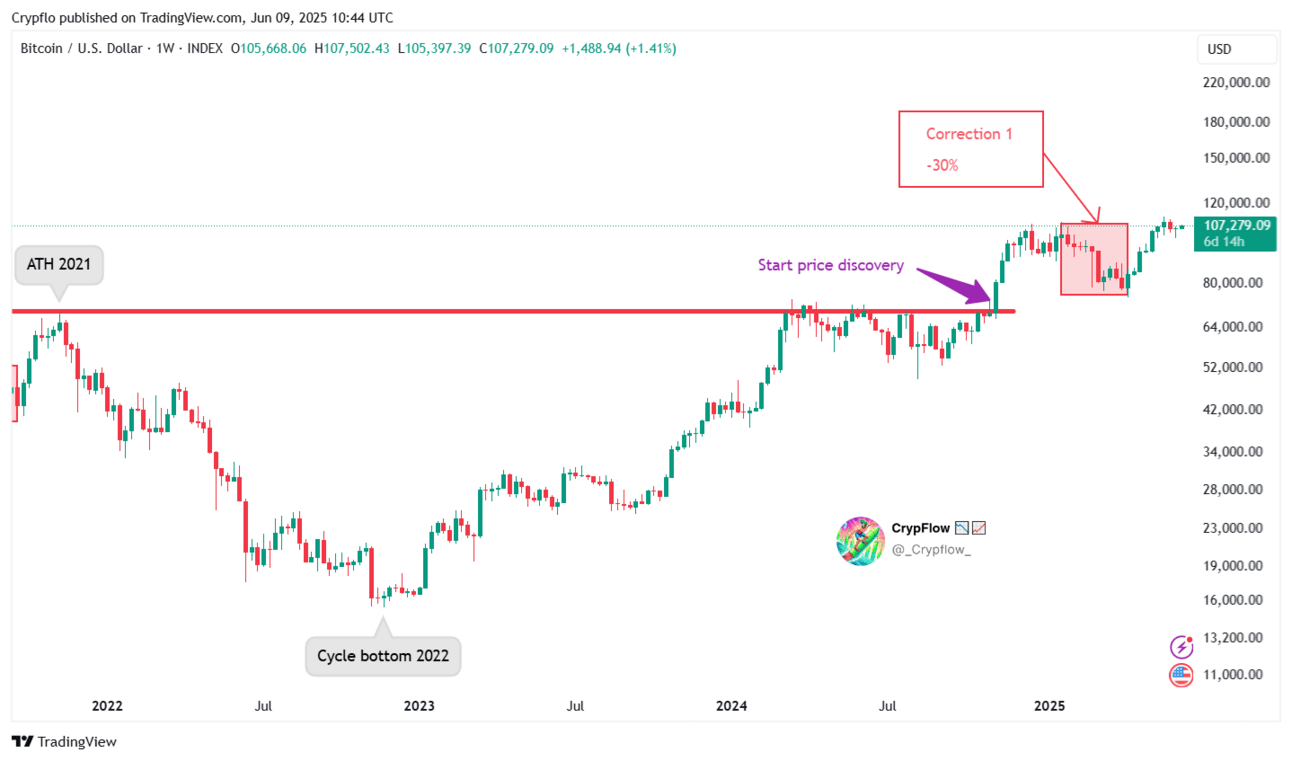

🔍 2021 Cycle: Only 1 price discovery correction… so far

This cycle, BTC fully broke above the 2021 high (~$69K) in March 2025. Since then:

✅ Only 1 clean -30% correction

✅ Breakout held

✅ Trend remains intact

Compared to previous cycles, we’re early in the price discovery phase.

🎯 What This Means

History doesn’t repeat, but it does leave clues.

Each cycle has featured multiple deep pullbacks after breaking ATHs. Right now, 2025 is still in early discovery mode with more legs likely ahead.

If you’re waiting for the cycle top… odds are, you’re early.

The trend is up. The structure is clean.

✅ Weak hands get shaken, strong hands get rewarded.

📊 Based on historical data, we can expect at least one more price discovery correction before this cycle tops out. But don’t get greedy at the second price discovery correction. Most of the buying should have happened at the lows in the bear market. I would not dare to take too much risk with the following corrections.

— CrypFlow